The Role of Technical Analysis in Cryptocurrency Trading Education

Technical analysis plays a crucial role in cryptocurrency trading education in Australia. As cryptocurrency trading is a highly volatile and fast-paced market, understanding technical analysis is essential for investors to make informed decisions.

Understanding Technical Analysis

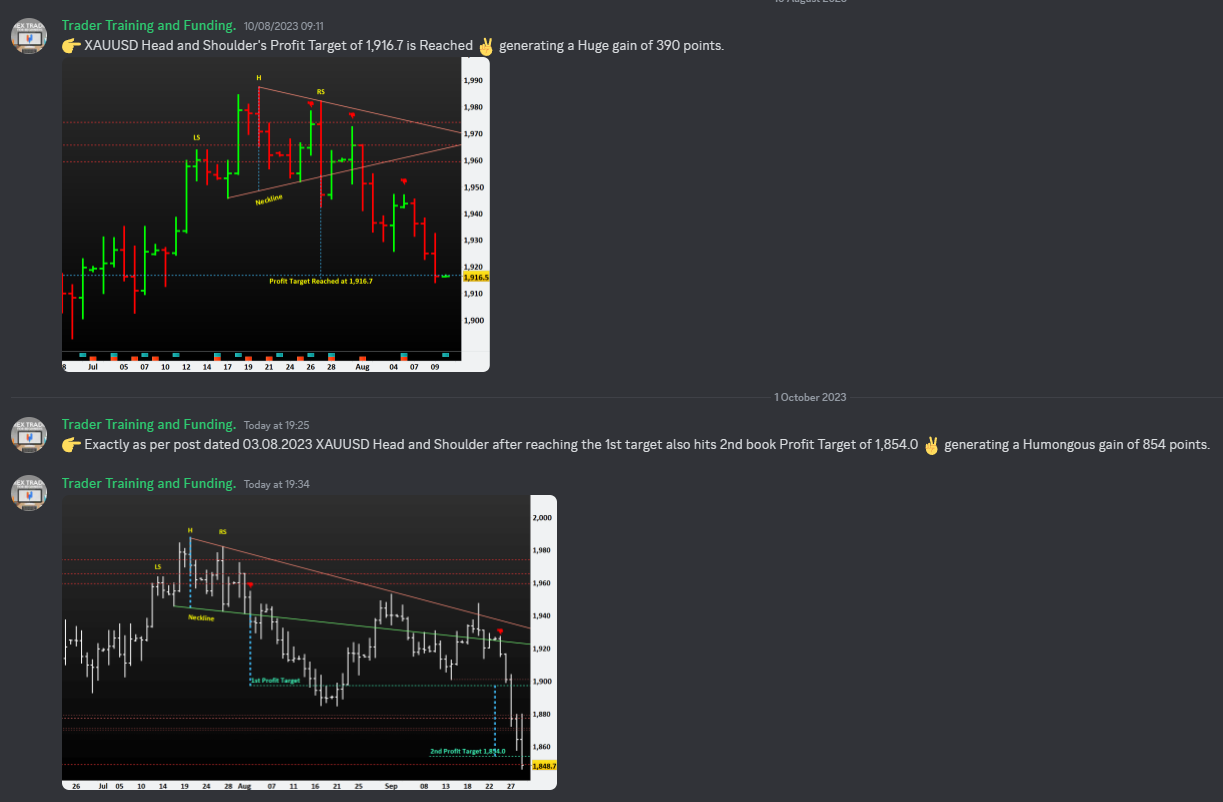

Technical analysis involves studying historical price data to predict future price movements. By analyzing charts, patterns, and various indicators, traders can identify potential entry and exit points for their trades. This allows traders to make more accurate predictions about market trends and improve their overall trading strategies.

Technical Analysis in Cryptocurrency Trading Courses

In cryptocurrency trading course in Australia, technical analysis is emphasized as a fundamental aspect of successful trading. Students are taught how to interpret different types of charts, such as candlestick charts, line charts, and bar charts. They also learn about various technical indicators, such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands.

Risk Management and Technical Analysis

Understanding technical analysis not only helps traders identify potential trading opportunities but also manage risks effectively. By analyzing market trends and patterns, traders can set stop-loss orders to limit their losses and protect their investments. This is especially important in the highly volatile cryptocurrency market, where prices can fluctuate rapidly.

Market Psychology and Technical Analysis

Moreover, technical analysis can also help traders gain a better understanding of market psychology. By studying price movements and volume patterns, traders can gauge market sentiment and make more informed decisions based on market dynamics.

Importance of Technical Analysis in Cryptocurrency Trading

Overall, technical analysis is a valuable tool for cryptocurrency traders to navigate the complex and unpredictable nature of the market. By acquiring knowledge and skills in technical analysis, traders in Australia can improve their trading performance and increase their chances of success in the cryptocurrency market. Cryptocurrency trading courses in Australia provide a solid foundation in technical analysis, equipping students with the tools and resources to make well-informed decisions and navigate the volatile market with confidence.

Conclusion

In conclusion, cryptocurrency trading courses in Australia vary in content, format, and cost. While some courses offer comprehensive education and practical trading experience, others may focus more on theoretical knowledge. It is important for individuals interested in pursuing a career in cryptocurrency trading to thoroughly research and choose a course that aligns with their learning preferences and goals. By understanding the structure of different courses, traders can better prepare themselves for success in the evolving cryptocurrency market.